A Guide to Foreign Exchange (FX) Trading

Understanding FX Spot Transactions

Foreign exchange (FX) trading is a critical component of the global financial system, providing the mechanism for converting one currency into another. This guide aims to provide a detailed understanding of FX spot transactions, which are the foundation of currency trading. We will explore the essential concepts, mechanisms, and practical applications involved in spot trading.

Foreign Exchange Spot Transactions

Introduction to FX Spot Transactions

Foreign exchange spot transactions are the most fundamental type of currency trade. These transactions involve the immediate exchange of one currency for another at an agreed-upon rate, typically settling within two business days. Spot transactions are the cornerstone of the FX market, facilitating global trade and investment by enabling currency conversion.

What is an Outright Transaction?

An outright transaction, commonly known as a spot transaction, is a straightforward exchange where two parties agree to trade a specified amount of one currency for another at the current market rate. The terms of the transaction include the amount of each currency, the exchange rate, and the settlement date. This simplicity masks the complex factors that influence exchange rates, including economic indicators, interest rates, and geopolitical events.

Value Dates

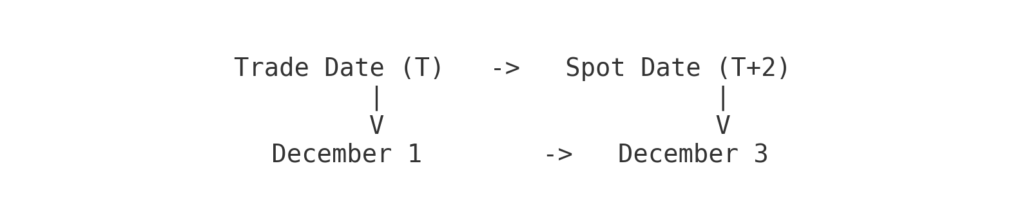

The value date, or settlement date, is when the actual exchange of currencies occurs. The standard settlement period in the FX market is two business days after the trade date, known as “T+2”. This allows time for the necessary arrangements and adjustments, considering different time zones and banking hours across countries.

Here’s an illustrative example of value dates:

Credit and Settlement Risks

Credit and settlement risks are inherent in FX transactions. Credit risk arises from the possibility that one party may default on their contractual obligations. In spot transactions, this risk is confined to the two-day period between the trade and settlement dates. However, settlement risk, which involves the potential for one party to fail to deliver the exchanged currency, can be more significant. This risk is heightened due to the time zone differences, as the delivery of currencies cannot be simultaneous.

Exchange Rate Quotation Terms

Exchange rates can be quoted in two primary ways: American terms and European terms. Understanding these conventions is crucial for accurate market interpretation.

- American Terms: The amount of US dollars per unit of another currency (e.g., EUR/USD = 1.20, meaning 1 EUR = 1.20 USD).

- European Terms: The number of units of a foreign currency per US dollar (e.g., USD/JPY = 110.00, meaning 1 USD = 110 JPY).

Exchange Rate Movements

Exchange rates fluctuate due to various economic and political factors. When the base currency (the first currency in a pair) strengthens, it buys more of the terms currency (the second currency). Conversely, if it weakens, it buys less. Traders often speculate on these movements, buying currencies they expect to strengthen and selling those they expect to weaken.

For example:

- If USD/JPY moves from 110.00 to 111.00, the USD has strengthened against the JPY.

Bids and Offers

In the FX market, the bid rate is the price at which a market maker is willing to buy the base currency, while the offer rate is the price at which they are willing to sell it. The difference between these two rates is known as the spread. The spread reflects the liquidity and volatility of the currency pair.

Example:

- Bid/Offer Spread: USD/JPY = 110.00/110.10

- Bid: 110.00 (buy USD, sell JPY)

- Offer: 110.10 (sell USD, buy JPY)

The Rule of the Left Bid – Right Offer

A fundamental trading convention is that market makers always trade the base currency. They buy the base currency at the left side of the quote (bid) and sell it at the right side (offer). This rule helps traders quickly identify the side of the market they need to engage with.

For example, with a quote of EUR/USD 1.2000/1.2005:

- A trader buying EUR will deal at 1.2005 (offer).

- A trader selling EUR will deal at 1.2000 (bid).

Cross Rates

Cross rates refer to the exchange rate between two currencies that do not involve the US dollar. These rates are often derived from the USD exchange rates of the two currencies. Understanding how to calculate cross rates is essential for trading less commonly paired currencies.

Formula for Cross Rates:

- If both currencies are quoted against USD: divide the base currency rate by the terms currency rate.

- If one currency is quoted in European terms and the other in American terms: multiply the rates.

Example:

- EUR/USD = 1.20

- USD/JPY = 110.00

- EUR/JPY = 1.20 * 110.00 = 132.00

Trading Conventions Among Market Makers

Market makers, primarily major multinational banks, provide liquidity by quoting two-sided markets (bid and offer prices). These quotes are typically held for a brief period and can change rapidly based on market conditions. Market makers have agreements on standard trade sizes and currencies, ensuring efficient and liquid markets.

Practical Applications and Review Problems

To solidify understanding, traders should engage in practical exercises, such as calculating value dates, determining bid/offer spreads, and deriving cross rates. These exercises help apply theoretical knowledge to real-world scenarios, enhancing trading skills and market comprehension.

Insights on FX Forwards

Foreign exchange (FX) trading extends beyond immediate spot transactions to include more complex instruments such as forwards. This section delves into the intricacies of Foreign Exchange Forwards, providing a detailed understanding of how these instruments work, how they are priced, and their significance in the broader FX market.

Foreign Exchange Forwards

Introduction to FX Forwards

Investors and traders in the FX market often require transactions that settle beyond the standard two-day spot period. These transactions, known as forwards, cater to the need for future settlement dates and play a crucial role in hedging, speculation, and financial planning. The forward market represents a significant portion of daily FX trading volume, highlighting its importance.

What Are Forwards?

Forwards are agreements between two parties to exchange currencies at a predetermined rate on a future date. Unlike spot transactions, forwards involve settlement dates beyond the typical two-day period, ranging from a few days to several years. This section breaks down the core elements of forwards:

- Outrights: A straightforward spot transaction for a future date. An outright consists of a spot transaction combined with a forward spread. The spot component is usually more volatile, driving most of the price action.

- Swaps: These involve the simultaneous buying and selling of the same currency with different maturities. A swap can either have a spot settlement for the near leg or be entirely forward (forward/forward). Essentially, a swap is a combination of a spot deal and a forward outright.

Calculating the Forward Rate

The forward rate is influenced by the spot rate and the interest rate differential between the two currencies involved. This rate neutralizes the impact of interest rate differences, ensuring no arbitrage opportunities exist between the forward and spot markets.

To illustrate, consider a dollar-based investor planning to invest in Sterling-denominated assets. The interest rate differential between the USD and GBP is 3% (USD: 2%, GBP: 5%). The investor must set the forward rate to convert Sterling back into dollars without exchange rate risk. Here’s the process:

- Determine the amount earned by investing in USD.

- Convert USD to GBP at the current spot rate.

- Calculate the future value of GBP after investing at the higher interest rate.

- Derive the forward rate that equates these cash flows, eliminating the interest rate differential.

Example Calculation:

- Spot Rate: 1.55 USD/GBP

- USD Investment: $1,000,000

- GBP Equivalent: £645,161.29 (1,000,000 / 1.55)

- Future Value of GBP: £677,419.35 (645,161.29 * 1.05)

- Forward Rate: 1.5061 (1,020,277.78 / 677,419.35)

The forward rate of 1.5061 USD/GBP ensures no arbitrage profit, maintaining equilibrium between the spot and forward markets.

Forward Points

Forward points represent the difference between the spot rate and the forward rate, reflecting the interest rate differential over the period until maturity. These points can be either positive or negative, depending on the relative interest rates of the currencies involved.

For example:

- Spot Rate: 1.5500 USD/GBP

- 1-Year Forward Points: 0.0439

- Forward Rate: 1.5061 USD/GBP (1.5500 – 0.0439)

To calculate forward points, use the formula:

![]()

Pay and Earn Points

Understanding whether to pay or earn forward points is crucial for determining the forward rate. If the interest rate of the currency being held is higher than the counter currency, the trader earns the points; otherwise, they pay the points.

- Earning Points: When holding the higher interest rate currency, the trader benefits from the differential and subtracts the forward points from the spot rate to determine the forward rate.

- Paying Points: When holding the lower interest rate currency, the trader incurs the cost of the differential and adds the forward points to the spot rate.

Practical Application

Let’s say a trader wants to buy GBP forward against the USD. Given the interest rate differential (USD lower than GBP), the trader earns forward points:

- Spot Rate: 1.5500 USD/GBP

- Forward Points: 0.0439

- Forward Rate: 1.5061 USD/GBP (1.5500 – 0.0439)

In contrast, buying JPY forward against the USD (with USD having a higher interest rate) would require paying the points:

- Spot Rate: 122.50 USD/JPY

- Forward Points: 0.2287

- Forward Rate: 122.2713 USD/JPY (122.50 – 0.2287)

Insights on FX Swaps

Foreign exchange (FX) trading encompasses various instruments beyond spot and forward transactions. FX swaps are a vital component of the FX market, providing flexibility and liquidity for traders and investors. This section delves into the intricacies of FX swaps, explaining their structure, uses, and calculation methods.

Foreign Exchange Swaps

Introduction to FX Swaps

An FX swap is a financial transaction that involves the simultaneous purchase and sale of identical amounts of one currency for another with two different value dates. FX swaps are used to manage liquidity, hedge currency risk, and facilitate speculative strategies. They are commonly used by financial institutions, corporations, and investors to adjust currency exposures without altering the underlying positions.

What is a Swap?

A swap transaction consists of two legs:

- Near Leg: The initial exchange of currencies, which can be for spot or forward settlement.

- Far Leg: The reverse exchange of currencies at a specified future date.

The primary purpose of a swap is to manage short-term liquidity needs and hedge against currency risk over the period between the two legs.

Value Dates

Value dates in an FX swap determine when the exchanges occur. The near leg typically settles on the spot date (T+2), while the far leg settles on a future date agreed upon by the parties involved. These dates are crucial for calculating the swap points and understanding the timing of cash flows.

For example:

- Near Leg: Trade Date (T) = January 1, Spot Date (T+2) = January 3

- Far Leg: Far Date (e.g., T+30) = January 31

Bid-Offer Spreads in Swaps

In FX swaps, the bid-offer spread represents the difference between the rates at which a dealer is willing to enter the near leg and the far leg of the swap. The spread reflects market conditions, including liquidity, volatility, and credit risk.

Example:

- Bid-Offer Spread: Near Leg USD/JPY = 110.00/110.10, Far Leg USD/JPY = 110.20/110.30

- Near Leg Bid: 110.00 (buy USD, sell JPY)

- Near Leg Offer: 110.10 (sell USD, buy JPY)

- Far Leg Bid: 110.20 (buy USD, sell JPY)

- Far Leg Offer: 110.30 (sell USD, buy JPY)

Calculating Swap Points

Swap points are the difference between the forward rate and the spot rate, adjusted for the interest rate differential between the two currencies over the swap period. The calculation of swap points involves determining the interest rate differential and applying it to the notional amount of the swap.

To calculate swap points, use the following formula:

![]()

For example:

- Spot Rate: 1.2000 USD/EUR

- Interest Rate Differential: 1.5% – 0.5% = 1%

- Notional Amount: $1,000,000

- Days: 30

![]()

Rules of Thumb

There are several rules of thumb that traders use to quickly estimate swap points and understand their implications:

- Positive Swap Points: Indicate that the currency with the higher interest rate is being sold forward.

- Negative Swap Points: Indicate that the currency with the higher interest rate is being bought forward.

- Interest Rate Parity: Ensures that the difference in interest rates between two currencies is offset by the forward exchange rate, preventing arbitrage opportunities.

Pay or Earn the Points

The concept of paying or earning swap points depends on the interest rate differential between the two currencies involved in the swap. If the trader holds the currency with the higher interest rate, they will earn the points; if they hold the currency with the lower interest rate, they will pay the points.

Example:

- If a trader buys USD and sells EUR in the near leg and reverses the transaction in the far leg:

- Near Leg: Buy USD at 1.2000 USD/EUR

- Far Leg: Sell USD at 1.2000 + 0.6944 = 1.26944 USD/EUR

The Rationale Behind the Swap

FX swaps are used for various strategic purposes:

- Liquidity Management: Adjusting cash flows to meet short-term liquidity needs.

- Hedging: Protecting against adverse currency movements.

- Speculation: Taking advantage of expected changes in interest rates or exchange rates.

Practical Applications

To fully grasp the use of FX swaps, practical applications and problem-solving exercises are essential. These exercises include calculating swap points, determining bid-offer spreads, and understanding the impact of interest rate differentials on swap pricing.

Exploring FX Options

Foreign exchange (FX) trading is not limited to spot, forward, and swap transactions. FX options add another layer of complexity and opportunity, providing traders with additional strategies to manage risk and capitalize on market movements. This section delves into the intricacies of FX options, explaining their structure, types, and practical applications.

Foreign Exchange Options

Introduction to FX Options

FX options are derivative contracts that give the holder the right, but not the obligation, to exchange a specific amount of one currency for another at a predetermined exchange rate on or before a specified date. Options provide flexibility and leverage, making them valuable tools for hedging and speculation.

Types of FX Options

- Vanilla Options:

- Call Option: Gives the holder the right to buy a currency pair at a specified strike price.

- Put Option: Gives the holder the right to sell a currency pair at a specified strike price.

- Exotic Options:

- Exotic options have more complex structures and conditions than vanilla options. Examples include barrier options, digital options, and basket options. These are typically used for specialized hedging strategies and speculative plays.

Payoff of Long and Short Call/Put Options

The payoff for options depends on the position (long or short) and the type of option (call or put).

- Long Call Option: The payoff is the positive difference between the spot price and the strike price, minus the premium paid.

Payoff=max(0,Spot Price−Strike Price)−Premium - Short Call Option: The payoff is the negative of the long call payoff.

Payoff=−max(0,Spot Price−Strike Price)+Premium - Long Put Option: The payoff is the positive difference between the strike price and the spot price, minus the premium paid.

Payoff=max(0,Strike Price−Spot Price)−Premium - Short Put Option: The payoff is the negative of the long put payoff.

Payoff=−max(0,Strike Price−Spot Price)+Premium

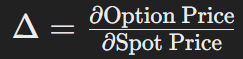

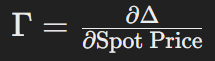

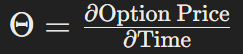

The Greeks

The Greeks are metrics that describe the sensitivity of an option’s price to various factors. They are crucial for understanding the risks and potential rewards associated with options trading.

- Delta (Δ): Measures the sensitivity of the option’s price to changes in the underlying asset’s price. It ranges from 0 to 1 for calls and -1 to 0 for puts.

- Gamma (Γ): Measures the rate of change of delta with respect to changes in the underlying asset’s price.

- Theta (Θ): Measures the sensitivity of the option’s price to the passage of time. It represents the time decay of the option’s value.

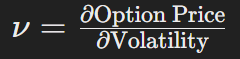

- Vega (ν): Measures the sensitivity of the option’s price to changes in the volatility of the underlying asset.

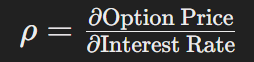

- Rho (ρ): Measures the sensitivity of the option’s price to changes in interest rates.

Trading Strategies

Options offer a variety of trading strategies to suit different market conditions and risk appetites. Some common strategies include:

- Straddles and Strangles: These involve buying both call and put options to profit from significant price movements in either direction.

- Spreads: Combining multiple options to limit potential losses while maintaining upside potential. Examples include bull spreads, bear spreads, and butterfly spreads.

- Hedging: Using options to protect against adverse price movements in an existing position.

Factors Affecting Option Value

Several factors influence the value of an FX option:

- Spot Price: The current exchange rate of the currency pair.

- Strike Price: The predetermined exchange rate at which the option can be exercised.

- Time to Maturity: The time remaining until the option expires.

- Volatility: The expected fluctuation in the underlying currency pair’s price.

- Interest Rates: The interest rate differential between the two currencies.

Practical Applications and Review Problems

Understanding FX options requires practical applications and problem-solving exercises. These exercises help traders apply theoretical knowledge to real-world scenarios, enhancing their trading skills and market comprehension. For example:

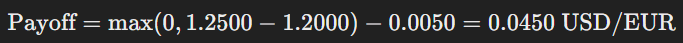

- Calculating Option Payoffs: Determine the payoff of a long call option with a strike price of 1.2000 USD/EUR, a premium of 0.0050, and a spot price of 1.2500.

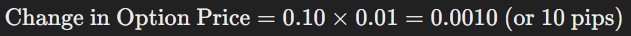

- Using the Greeks: Assess the impact of a 1% increase in volatility on the price of an option with a vega of 0.10.

In conclusion, mastering FX spot transactions, forwards, swaps, and options equips traders with a well-rounded understanding of the foreign exchange market. This knowledge is crucial for making informed trading decisions, managing risks, and optimizing returns. As the FX market continues to evolve, staying informed and adaptable is key to success. Happy trading!