Volatility at the Open: The 5-Minute ORB Trading Strategy

Introduction

Background of Financial Markets

The financial markets have undergone a significant transformation over the past few decades. Initially dominated by Wall Street professionals, these markets were once the exclusive domain of institutional investors and large trading firms. However, the landscape began to change with the advent of advanced trading technologies, the proliferation of financial information, and the rise of accessible, low-cost brokerage services. This democratization of trading has opened the doors for individual investors, allowing them to participate in the financial markets alongside traditional institutional players.

Rise of Retail Trading

The shift from Wall Street to Main Street investors accelerated dramatically in the early 21st century. By 2023, 61% of adults in the United States were directly invested in the stock market. Several factors contributed to this surge in retail trading activity. The widespread availability of online trading platforms, real-time market data, and educational resources made trading more accessible than ever before. Additionally, the COVID-19 pandemic acted as a catalyst, with lockdowns and increased market volatility prompting a surge in retail trading. A landmark event illustrating the power of retail traders was the 2021 GameStop short squeeze, where a collective effort by retail investors led to significant market disruptions, showcasing their ability to influence stock prices and challenge institutional investors.

A Guide to Foreign Exchange (FX) Trading

Challenges for Retail Traders

Despite the increased participation of retail traders, they face numerous challenges in the highly competitive financial markets. One of the most significant obstacles is the prevalence of high-frequency trading (HFT) algorithms. These sophisticated systems, operated by large trading firms, execute trades at lightning speeds, often capitalizing on minute price discrepancies and market inefficiencies. Retail traders, with limited access to such advanced technologies and data, must rely on proven strategies that can provide a consistent edge. Technical analysis and well-developed trading systems are crucial for retail traders to compete effectively and achieve consistent returns.

Objective of the Article

This article aims to investigate the profitability of the Opening Range Breakout (ORB) strategy, particularly focusing on the 5-minute ORB variant. The ORB strategy, which identifies and trades breakouts from the initial price range established in the first minutes of the trading day, has been widely studied and implemented in various forms. Our research analyses its effectiveness using a comprehensive dataset of over 7,000 US stocks traded between 2016 and 2023. By examining the performance of the 5-minute ORB strategy and incorporating factors such as trading volume and stock-specific news, this article seeks to determine whether this approach can produce consistent, uncorrelated returns for retail traders.

Strategy Definition

Overview of ORB Strategy

The Opening Range Breakout (ORB) strategy is a widely used day trading method that capitalizes on the price movements occurring within the initial minutes of the trading day. The core principle involves identifying the highest and lowest prices established within a specified initial time frame and placing trades when the price breaks out of this range. Common variations of the ORB strategy include the 5-minute, 15-minute, 30-minute, and 60-minute time frames. In this article, we focus specifically on the 5-minute ORB strategy.

Historical Context

The ORB strategy was perhaps first brought to the mainstream by Toby Crabel in 1990 through his influential work, “Day Trading with Short Term Price Patterns and Opening Range Breakout.” Crabel’s research provided a detailed analysis of volatility breakout strategies across various markets, emphasizing the importance of understanding market participant behaviour. Over the years, the ORB strategy has been refined and extensively studied, gaining recognition for its potential profitability.

Methodology

Stock Selection Criteria

To implement the 5-minute ORB strategy effectively, it is essential to select stocks that exhibit sufficient liquidity and volatility. The criteria for choosing stocks are as follows:

- Opening Price: The stock must have an opening price above $5, ensuring the exclusion of low-priced, highly volatile penny stocks.

- Average Trading Volume: The stock must have an average trading volume of at least 1,000,000 shares per day over the previous 14 days, ensuring liquidity and minimizing price slippage.

- Average True Range (ATR): The stock must have an ATR of more than $0.50 over the previous 14 days, indicating adequate price movement for the strategy to be effective.

Trade Execution

The execution of trades in the 5-minute ORB strategy involves several key steps to ensure precise entry and effective risk management:

- Defining the Opening Range: At the end of the first five minutes of trading (9:30 am to 9:35 am ET), identify the high and low prices of this period. These prices define the opening range.

- Placing Stop Orders:

- Bullish Scenario: If the stock shows a bullish trend (closing above the opening price in the first five minutes), place a stop order to buy at the high of the opening range.

- Bearish Scenario: If the stock shows a bearish trend (closing below the opening price in the first five minutes), place a stop order to sell at the low of the opening range.

- Doji Scenario: If the opening price and closing price are the same (forming a doji), no trade is initiated.

- Managing Positions:

- Stop Loss: Set a stop loss at a distance of 10% of the ATR from the entry price. This helps to cap potential losses.

- Profit Target: If the stop loss is not triggered during the day, close the position at the end of the trading session (4:00 pm ET) to secure profits or minimize losses.

- Position Sizing: Each position is sized such that the maximum loss, if the stop loss is hit, is limited to 1% of the trading capital. A maximum leverage constraint of 4x is applied, consistent with the regulations of most US FINRA-regulated brokers.

Performance Metrics

To evaluate the effectiveness and profitability of the 5-minute ORB strategy, several performance metrics are employed:

- Profit and Loss (PnL): The total profit or loss generated by the strategy over a specified period, providing a straightforward measure of the strategy’s financial outcome.

- Sharpe Ratio: This ratio measures the risk-adjusted return of the strategy. It is calculated by subtracting the risk-free rate from the strategy’s return and then dividing by the standard deviation of the returns. A higher Sharpe ratio indicates a more favourable risk-adjusted performance.

- Maximum Drawdown (MDD): This metric represents the largest peak-to-trough decline in the portfolio value during the trading period. It is a critical measure of downside risk, indicating the worst potential loss an investor could have experienced.

Not All Opening Ranges Are Created Equally

Importance of Stocks in Play

Definition and Identification of Stocks in Play: Stocks in Play are stocks that exhibit significantly higher trading activity compared to their usual volume, often driven by underlying fundamental news or events. These stocks tend to have expanded daily price ranges and distinct intraday trends, making them ideal candidates for day trading strategies like the ORB.

Common Catalysts: Several key events can turn a stock into a Stock in Play, including:

- Earnings Reports: Regular quarterly or annual financial results that can cause significant price movements based on performance against expectations.

- Earnings Warnings or Pre-announcements: Early alerts about expected earnings that can lead to sharp market reactions.

- Earnings Surprises: Results that significantly differ from market expectations, leading to volatility.

- FDA Approvals or Disapprovals: Regulatory decisions, particularly in biotech and pharmaceutical sectors, that can dramatically impact stock prices.

- Mergers and Acquisitions: Announcements of company mergers or acquisitions that influence stock valuation.

- Alliances, Partnerships, or Major Product Releases: Strategic partnerships or the launch of significant new products or services.

- Major Contract Wins or Losses: Acquisition or loss of substantial contracts.

- Restructuring, Layoffs, or Management Changes: Organizational changes that affect investor sentiment.

- Stock Splits, Buybacks, or Debt Offerings: Financial manoeuvres impacting stock liquidity and valuation.

- Break of Key Technical Levels: Technical analysis points where breaking significant support or resistance levels can lead to increased trading activity.

Relative Volume

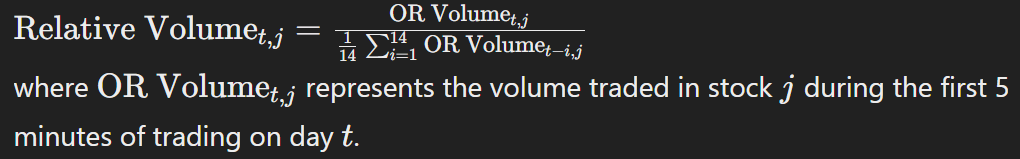

Explanation of Relative Volume: Relative Volume (RVOL) is a measure that compares the current trading volume of a stock to its average volume over a specific period. It provides insight into whether a stock is experiencing unusually high or low trading activity. Higher RVOL indicates heightened interest and activity, which is often associated with significant price movements.

Calculation of Relative Volume: Relative Volume for a stock on a particular day is calculated as follows:

Analysis of Relative Volume Impact

To understand the impact of Relative Volume on the profitability of the ORB strategy, we analyse the correlation between RVOL and the average Profit and Loss (PnL) generated by the strategy. By grouping trades based on different RVOL levels, we can observe how the ORB strategy performs under varying levels of trading activity.

Correlation Findings: Our analysis demonstrates a strong positive correlation between Relative Volume and the profitability of the 5-minute ORB strategy. As RVOL increases, the average PnL per trade also tends to increase. This suggests that focusing on stocks with higher-than-average trading activity can significantly enhance the performance of the ORB strategy.

Opening Range Breakout on Stocks in Play

Enhanced Strategy

Introduction of an Improved ORB Strategy: Building on the base 5-minute ORB strategy, we introduce an enhanced approach that focuses exclusively on Stocks in Play with high Relative Volume. By adding a filter to select only the top 20 stocks with the highest RVOL during the opening range, we aim to increase the likelihood of capturing significant price movements.

Enhanced Strategy Filters:

- The opening price must be above $5.

- The average trading volume over the previous 14 days must be at least 1,000,000 shares per day.

- The ATR over the previous 14 days must be more than $0.50.

- The Relative Volume must be at least 100%.

- Only the top 20 stocks with the highest Relative Volume are traded.

Performance Comparison

Equity Curve and Performance Statistics: The performance of the enhanced ORB strategy is compared against the base strategy and the S&P 500 index over the same period (January 1, 2016, to December 31, 2023). The enhanced strategy demonstrates a substantial improvement in returns.

Equity Curve: The equity curve of the enhanced strategy shows a significant upward trajectory compared to the base strategy and the S&P 500, indicating superior performance.

Performance Metrics:

- Total Return: The enhanced strategy achieves a total net return of approximately 1,637%, significantly outperforming the base strategy and the S&P 500.

- Internal Rate of Return (IRR): The annualized IRR of the enhanced strategy is 41.6%, compared to 3.2% for the base strategy.

- Volatility: The enhanced strategy has a volatility of 14.8%, slightly higher than the base strategy but justified by the higher returns.

- Sharpe Ratio: The enhanced strategy achieves a Sharpe ratio of 2.81, indicating a very favourable risk-adjusted return compared to 0.48 for the base strategy.

- Maximum Drawdown (MDD): The MDD for the enhanced strategy is 12%, lower than the base strategy’s 13%, suggesting better risk management.

- Alpha: The enhanced strategy has an annualized alpha of 36%, indicating that the strategy generates substantial returns independent of the market.

Opening Range Breakout on Other-Time Frames

Multi-Time Frame Analysis

The Opening Range Breakout (ORB) strategy can be applied across various time frames, allowing traders to exploit price movements within different intervals of the trading day. This section explores the performance of ORB strategies using 5-minute, 15-minute, 30-minute, and 60-minute time frames. Each time frame provides a different perspective on market volatility and liquidity, influencing the strategy’s effectiveness.

- 5-Minute ORB: This strategy captures price movements based on the range established in the first five minutes of trading. It is highly reactive and aims to capitalize on the initial market volatility.

- 15-Minute ORB: This variation defines the opening range over the first 15 minutes of trading, offering a slightly longer perspective and potentially filtering out some initial noise.

- 30-Minute ORB: Extending the opening range to 30 minutes allows traders to capture more stable price trends that develop after the initial market open.

- 60-Minute ORB: The longest time frame considered, capturing the range over the first hour of trading. It aims to identify more significant trends and reduce the impact of early market fluctuations.

Performance Metrics

To evaluate the effectiveness of ORB strategies across different time frames, we compare key performance metrics:

- Total Return: Measures the overall profitability of the strategy over the analysis period.

- Internal Rate of Return (IRR): Indicates the annualized return, accounting for the timing of cash flows.

- Volatility: Assesses the degree of price fluctuation in the strategy’s returns.

- Sharpe Ratio: Evaluates the risk-adjusted return, comparing the strategy’s return to its volatility.

- Maximum Drawdown (MDD): Represents the largest peak-to-trough decline in portfolio value.

- Alpha: Measures the excess return generated by the strategy relative to the market.

Comparison of Performance Metrics:

| Time Frame | Total Return | IRR | Volatility | Sharpe Ratio | MDD | Alpha |

|---|---|---|---|---|---|---|

| 5-Minute | 1,637% | 41.6% | 14.8% | 2.81 | 12% | 36% |

| 15-Minute | 272% | 17.4% | 12.2% | 1.43 | 11% | 16.9% |

| 30-Minute | 21% | 2.3% | 11.1% | 0.21 | 35% | 2.8% |

| 60-Minute | 39% | 4.1% | 10.2% | 0.40 | 21% | 4.4% |

| COMBO | 234% | 15.8% | 7.9% | 1.99 | 7% | 15.0% |

The 5-minute ORB strategy significantly outperforms other time frames, demonstrating superior returns and a higher Sharpe ratio. The shorter time frame captures the most pronounced price movements immediately after the market opens, making it the most effective for day trading.

Best/Worst Performers on 5-Minute ORB

Top Performers

An analysis of the best-performing stocks using the 5-minute ORB strategy reveals stocks that consistently generated high returns. These top performers are characterized by high volatility and significant trading activity, making them ideal for the ORB strategy.

Top Performing Stocks:

| Ticker | PnL (R) | Win Ratio (%) |

|---|---|---|

| DDD | 385 | 21% |

| FSLR | 370 | 20% |

| NVDA | 309 | 19% |

| SWBI | 272 | 24% |

| RCL | 271 | 20% |

Worst Performers

Conversely, the worst-performing stocks under the 5-minute ORB strategy highlight the challenges of trading less volatile or less liquid stocks. These stocks often fail to produce the significant price movements needed for the ORB strategy to be effective.

Worst Performing Stocks:

| Ticker | PnL (R) | Win Ratio (%) |

|---|---|---|

| CMC | -154 | 12% |

| TRGP | -132 | 14% |

| CSX | -128 | 12% |

| CNP | -127 | 13% |

| BJ | -120 | 10% |

Insights and Observations

Key Takeaways:

- High Volatility and Liquidity: The best-performing stocks in the 5-minute ORB strategy are those with high volatility and trading volume. These characteristics enable significant price movements, which are essential for the strategy’s success.

- Relative Volume: Stocks with high relative volume often exhibit stronger performance in the ORB strategy. This metric helps in identifying Stocks in Play, which are more likely to experience significant intraday trends.

- Time Frame Impact: The 5-minute time frame consistently outperforms longer time frames. It captures the initial volatility of the market open, which is crucial for day trading strategies like the ORB.

- Risk Management: Effective risk management, including appropriate stop loss levels and position sizing, is critical in minimizing losses from the worst-performing stocks and maximizing gains from the best performers.

- Strategy Robustness: The strategy’s robustness across different stocks and time frames suggests that it can be a valuable tool for day traders. However, its effectiveness is highly dependent on the selection of appropriate stocks and the correct application of the strategy.

Conclusion

Summary of Findings

Our comprehensive analysis of the Opening Range Breakout (ORB) strategy within the US equity market has yielded significant insights into its profitability and viability as a day trading approach. By examining a vast dataset covering over 7,000 US stocks traded from 2016 to 2023, we highlighted the substantial potential of the ORB strategy, particularly the 5-minute ORB variant. Key findings include:

- The 5-minute ORB strategy achieved a net performance of over 1,637%, with a Sharpe ratio of 2.81 and an annualized alpha of 36%.

- Stocks in Play, identified using high Relative Volume, significantly enhanced the strategy’s effectiveness, resulting in more consistent and profitable trades.

- Multi-time frame analysis revealed that the 5-minute ORB outperformed longer time frames, capturing the initial market volatility effectively.

Implications for Traders

The findings from this article have several practical implications for retail traders:

- Stock Selection: The importance of selecting high Relative Volume stocks, or Stocks in Play, cannot be overstated. These stocks are more likely to exhibit significant price movements, providing better trading opportunities.

- Risk Management: Implementing strict stop loss and position sizing rules is crucial to managing risk and maximizing returns. The strategy’s success is partly attributed to its disciplined approach to risk management.

- Focus on Shorter Time Frames: The 5-minute ORB strategy’s superior performance suggests that shorter time frames can be more effective for day trading. Traders should consider focusing on these shorter intervals to capture early market movements.

Future Research

While this article provides robust evidence of the ORB strategy’s effectiveness, there are several areas for future research:

- Further Investigation into the 5-Minute ORB: Understanding why the 5-minute ORB outperforms longer time frames could provide deeper insights into market dynamics and trader behaviour.

- Impact of Market Conditions: Analysing how different market conditions (e.g., bull vs. bear markets) affect the ORB strategy’s performance could help in refining the approach.

- Integration of Additional Variables: Exploring other technical indicators and their integration with the ORB strategy could enhance its predictive power and profitability.

- Real-time Adaptation: Developing adaptive algorithms that adjust the ORB strategy parameters in real-time based on market conditions and stock-specific factors could further improve trading outcomes.